Wednesday, May 27, 2009

Monday, May 25, 2009

Sunday, May 24, 2009

Tuesday, May 12, 2009

Tuesday, May 5, 2009

How Lehman Brothers Got Its Real Estate Fix

How Lehman Brothers Got Its Real Estate Fix

Photo Illustration by The New York Times

By DEVIN LEONARD

Published: May 2, 2009

BACK when he was a major Wall Street deal maker, Mark A. Walsh, the former head of the global real estate group at Lehman Brothers, had a running joke with Carmine Visone, one of his managing directors. Mr. Visone, 10 years older than his boss, would lecture Mr. Walsh about the importance of fundamentals: land values, construction cost and rents.

Marilynn K. Yee/The New York Times; Chester Higgins Jr./The New York Times; Richard Drew/Associated Press

Mark Walsh and Lehman Brothers financed blockbuster property deals in Manhattan, including the purchases of, from left, the Woolworth Building, the Seagram Building and Lever House.

John Lei for The New York Times

Mark Walsh led Lehman’s global real estate group before the market, and the bank, collapsed.

“He’ll be back,” said the real estate developer Aby Rosen.

As Mr. Visone remembers it, Mr. Walsh would wave his hand dismissively and would argue just as emphatically that the best way to make office buildings spew cash was through the magic of financial engineering. Typically, Mr. Visone gave in.

“He was too smart for me,” Mr. Visone recalls.

Many others were equally in awe of Mr. Walsh’s intellect. Until Lehman Brothers collapsed last September, Mr. Walsh was considered the most brilliant real estate financier on Wall Street. In the ’90s, he pioneered the art of lending to office building developers and then slicing up and repackaging the debt for investors. Less risky pieces went to institutional investors; the lower-rated chunks to hedge funds and others hungry for juicier returns. Lehman pocketed a fee every step of the way, and it often retained a risky piece or two to give its own earnings a kick.

“That was one of Lehman’s strengths,” says Brad Hintz, a former chief financial officer at Lehman who is now an analyst at Sanford C. Bernstein. “In fact, a lot of Wall Street firms tried to duplicate Lehman’s commercial real estate strategy.”

Mr. Walsh, who wore rumpled Brooks Brothers suits and could be painfully awkward in front of crowds, was one of Lehman’s biggest profit producers. Former Lehman executives say Richard S. Fuld Jr., the bank’s chief, relied on Mr. Walsh to bankroll the firm’s swanlike transformation from a second-tier bond trading shop into a full-service investment bank. Former members of his unit, who requested anonymity because they were concerned about being swept up in lawsuits and investigations surrounding Lehman’s collapse, say it generated more than 20 percent of Lehman’s $4 billion in profits at the peak of the real estate boom in 2006.

Many factors, of course, contributed to Lehman’s demise last fall. Near the end, it carried $25 billion in toxic residential mortgages. It was wildly overleveraged. And the federal government made the fateful decision not to rescue Lehman from its mistakes. But when real estate overheated in the years before Lehman’s implosion, Mr. Walsh made billions of dollars in loans and equity investments that also ultimately helped bring down the bank.

Lehman’s bankruptcy hasn’t quelled the controversy about Mr. Walsh’s activities. Last fall, the United States attorney’s office in Manhattan subpoenaed him and other former Lehman executives as part of an investigation into whether the firm improperly valued its commercial real estate holdings, among other things. In March in a civil complaint, Anne Milgram, the New Jersey attorney general, accused Mr. Walsh and 17 other former Lehman officials of defrauding the state’s pension funds by misrepresenting Lehman’s real estate exposure.

Mr. Walsh, 49, declined to be interviewed for this article.

His former co-workers and clients remain staunchly loyal. “I have the greatest respect for him personally and professionally,” says Richard S. Ziman, the former C.E.O. of Arden Realty, a company based in Los Angeles that Mr. Walsh helped take public in 1996 and sell in 2006. “I’d testify in court if that was necessary.”

But even among Mr. Walsh’s supporters, a nagging question remains: How could a real estate wizard who built a thriving business by creating new ways of managing risk by sweeping loans off Lehman’s balance sheet end up doing deals that contradicted everything he seemed to stand for — and contribute to the collapse of one of Wall Street’s most venerable firms?

MR. WALSH grew up in Yonkers, the son of a lawyer who once served as chairman of the New York City Housing Authority. He attended Iona Preparatory School in New Rochelle; the College of the Holy Cross, where he majored in economics; and, finally, the Fordham University School of Law.

After receiving his law degree in 1984, he worked as a real estate lawyer in Miami and handled a lot of foreclosures. That came in handy when he took a job at Lehman in 1988, at the end of an earlier real estate boom that left banks and insurers saddled with mountains of bad loans.

Mr. Walsh bought and sold loans on properties that were often in foreclosure. There were bargains galore. He generated hundreds of millions of profits for the firm and won the confidence of Mr. Fuld, who gave him the authority to make huge loans. Then, along with Ethan Penner of Nomura Securities and Andrew D. Stone of Credit Suisse First Boston, Mr. Walsh discovered securitization. This created an entirely new market for commercial real estate debt. No longer would lenders have to shoulder all the risk from real estate lending. Wall Street could make the same loans and sell them off. The challenge then became lassoing the right kind of developers to back.

The three men marketed their services very differently. Mr. Penner hired Bob Dylan, Stevie Nicks and the Eagles to serenade clients, while Mr. Stone jetted around the country with the likes of Donald Trump. The publicity-shy Mr. Walsh was more understated. Mr. Ziman says Mr. Walsh went fly-fishing with clients in Colorado and Montana.

Developers also loved the fact that Mr. Walsh was willing to lend them enormous sums. In 1997, Barry Sternlicht, then the chief executive of Starwood Hotels and Resorts, needed $7 billion to buy ITT.

“I called up Mark and Goldman Sachs and said, ‘Would you be interested?’ ” he recalls. “Goldman said they were. They came to see us. But we needed to get it done really quickly. Mark said, ‘Yeah, we’ll do it.’ I said, ‘Really? You are going to do it yourselves?’ He said, ‘Yup.’ ”

Mr. Sternlicht says Mr. Walsh brought Mr. Fuld himself to a meeting at the hotelier’s home to assure him that Lehman would back his acquisition. “Dick Fuld sat there in my living room and said: ‘You have our word. We’ll get this done,’ ” Mr. Sternlicht recalls. “We paid a $20 million fee. I was never so happy paying a fee.” Mr. Fuld declined to be interviewed for this article.

During the late ’90s, Mr. Walsh forged close ties with many of the most prominent developers in New York. He bankrolled Tishman Speyer in its purchase of the Chrysler Building in 1997. He backed Steven C. Witkoff in his purchase of the Woolworth Building in 1998. And he financed the acquisitions by the German real estate developers Aby Rosen and Michael Fuchs of the landmark Lever House and Seagram Building.

Mr. Rosen recalls that he and Mr. Walsh closed the $375 million Seagram Building deal in four weeks. “He was fast,” says Mr. Rosen. “He doesn’t try to kill you or retrade. To be honest, there are very few people in the industry you can say that about.”

Mr. Walsh was also skilled at making all that debt vanish from Lehman’s balance sheet before the firm choked on it. On the eve of the financial crisis brought by the near collapse of Long Term Capital Management in 1998, Lehman flushed $3.6 billion in commercial real estate loans through its securitization machine, avoiding some of the losses that crippled other firms, including Nomura and Credit Suisse.

Mr. Walsh was rewarded with more responsibility, and in 2000 was named co-head of a new private equity group dedicated to real estate investments. After raising $1.6 billion from pension funds and university endowments and delivering an internal rate of return of more than 30 percent, the equity franchise easily raised $2.4 billion for a second fund, which closed in 2005. While the market was heating up and low-priced deals were harder to find, the second fund still generated a 15 percent return.

But the funds’ structure created perverse incentives within Mr. Walsh’s group, according to two former members of his team who requested anonymity because of confidentiality agreements they had signed with Lehman.

Lehman owned 20 percent of the funds. Institutions and wealthy investors controlled the rest. Mr. Walsh, in order to raise money, promised to give the outsiders a first peek at deals.

If institutional investors and others passed, Mr. Walsh’s bankers were free to make the same investments with the firm’s money — which was just fine with his troops: they received bigger bonuses on the riskier deals because Lehman didn’t have to share the profits.

But it also meant that more deals that could go wrong ended up on Lehman’s balance sheet. And this is exactly what happened with a set of deals known as “bridge equity” financings.

As real estate went into overdrive in 2003, Mr. Walsh, in order to help clients pump up their offers in heated bidding wars, started frequently putting Lehman’s own cash into deals — alongside the debt they raised. With its cash on the line, Lehman would be dangerously exposed in any downturn, so, once a deal closed, the firm would try to sell its equity stake as quickly as possible.

Lehman made ripe 4 percent fees for its equity investments — twice the going rate for loan securitization. As long as the market was rising, Mr. Walsh’s group was fine. But if the bank couldn’t sell the bridge equity and if real estate prices fell, it could end up with nothing.

“It was a classic assumption that values are going to be higher a year from now,” says Mike Kirby, chairman of Green Street Advisors, a research firm. “That was the mentality at the time.”

Bridge equity quickly became one of Lehman’s signature products, and Mr. Walsh’s group deployed it in dozens of deals, including Tishman Speyer’s $1.7 billion purchase of the MetLife Building on Park Avenue in 2005 and Beacon Capital Partners’ acquisition of the News Corporation’s headquarters on the Avenue of the Americas for more than $1.5 billion in 2006.

“Guys like Tishman Speyer wanted as much of this product as they could get,” says a former real estate banker at a competing Wall Street firm, who requested anonymity because of confidentially agreements he had signed with the bank. “For them, it was a no-brainer. It was like, ‘Bring as much of this on as possible.’ ”

By all accounts, Mr. Walsh made piles of money. He had perks like a corner office over Park Avenue with a private conference room. Yet his ego never matched the size of his deals. Friends say Mr. Walsh lived in a modest home in Rye, N.Y., with his wife, Lisa, and their three boys. His main interest outside of work and family was fishing.

“At the end of the day, he is content to throw a line in the water and fish by himself,” says his friend Dan McNulty, co-chairman of DTZ Rockwood, a real estate investment bank in New York. “He’s a very reflective guy.”

IF Lehman and Mr. Walsh were convinced about the virtues of bridge equity, outside investors weren’t. “It was a gray area,” says a former Lehman executive who asked not to be identified because of his confidentiality agreements with the firm. “It wasn’t the kind of risk that the investors had signed up for. The funds never participated in those deals.”

One partnership pursued by Mr. Walsh exemplified his newfound appetite for ever riskier deals: transactions with the SunCal Companies of Irvine, Calif., an operation with an intriguing business model. It bought land, primarily in its home state, and sought government approval for residential development. If it got the green light, it sold the land to builders for an enormous profit. Mr. Walsh lent SunCal more than $2 billion and formed a close relationship with its founder, Boris Elieff. Mr. Elieff did not return calls seeking comment.

“We had other Goldman Sachs and other people who were clamoring to do business with us,” says Louis Miller, a lawyer for SunCal. “Lehman said, ‘No, we want to you to be exclusive with us.’ They loved SunCal.”

But because the cash flow from the SunCal deals was hard to predict, Lehman’s loans to the company were nearly impossible to syndicate. After all, how do you estimate income from raw land that may or may not be approved for development?

After putting about $140 million from the funds into SunCal deals, Mr. Walsh discovered that the investors wanted out. In 2006, he cashed them out with a tidy profit in exchange for effectively transferring their ownership stake onto Lehman’s balance sheet. That left Lehman with even more SunCal exposure, just before the emergence of the subprime crisis that would pummel the Southern California real estate market.

Others were already sensing danger, and some of Mr. Walsh’s longtime clients started to pull back. Mr. Ziman of Arden Realty sold his company to GE Capital in 2006. He said the real estate market — and, indeed, the entire financial system behind it — was becoming increasingly bizarre.

“Every Monday, I’d get these e-mails from all the investment banks about the deals of the week,” Mr. Ziman recalls. “I kept saying, ‘Where is all this money coming from?’ ”

Lehman wasn’t the only bank throwing bridge equity into real estate. In October 2006, Wachovia and Merrill Lynch pledged $1.5 billion for Tishman Speyer’s $5.4 billion acquisition of Stuyvesant Town, the huge apartment complex in Manhattan. In February, Goldman Sachs, Morgan Stanley and Bear Stearns put up $3.5 billion into the Blackstone Group’s $32 billion deal to buy Equity Office Properties Trust.

Missing out on the Stuyvesant Town deal stung Lehman, said one of the firm’s bankers who declined to be identified because he wasn’t authorized to speak publicly about his time at Lehman. It wasn’t just the lost fees. Mr. Walsh considered Tishman Speyer a core client. What’s more, Tishman Speyer’s chairman, Jerry Speyer, had a close relationship with Mr. Fuld. They were both board members of the Federal Reserve Bank of New York; Mr. Speyer and Mr. Fuld’s wife, Kathleen, were trustees of the Museum of Modern Art.

And it wasn’t long before Mr. Walsh found a way to do an even bigger deal with Mr. Speyer’s company. In May 2007, Lehman and Tishman Speyer offered to buy Archstone-Smith Trust, a $22 billion deal struck at the peak of an already dangerously frothy market. Tishman Speyer put up a mere $250 million of its own equity. Lehman, in a 50-50 partnership with Bank of America, put up $17.1 billion of debt and $4.6 billion in bridge equity financing.

As the credit crisis began to set in during the following summer, the financing for the Archstone deal appeared imperiled. With the markets spiraling downward, rumors were rife that Lehman was having problems and that it might walk away from the Archstone transaction.

Mr. Speyer phoned Mr. Fuld to make sure that he still had Lehman’s backing. “When I placed that call, I knew it was preposterous,” Mr. Speyer recalled in an interview with The New York Times in 2007. “I placed it because I had to. But I knew when I was dialing how the conversation would come out.”

Lehman stuck by Mr. Speyer, and the deal was completed in October 2007. Had Lehman walked away, the partners would have absorbed a $1.5 billion breakup fee. In hindsight, it would have been smart to swallow that loss. But several people involved in the deal say the parties thought that the subprime mortgage crisis would actually help Archstone because people who could no longer afford houses would rent the company’s apartments.

And for his part, Mr. Walsh was reluctant to jeopardize an important client relationship.

A former Lehman executive, who declined to be identified because he wasn’t authorized to speak publicly about his time at the firm, said: “We were very loyal to our clients and had a culture of standing by our clients, even when the road got bumpy. We did not back away from commitments. We could not have built such a dominant franchise with any other approach. That culture, of course, has its risks and downside, including losing money on some transactions.”

Mr. Walsh tried to limit Lehman’s risk. He sold $8.9 billion of the Archstone debt to Fannie Mae and Freddie Mac and persuaded Bank of America and Barclays to buy $2.4 billion of the bridge equity. Even so, Lehman ended up with nearly 25 percent of a hugely overpriced deal just as real estate was imploding. This time, Lehman couldn’t sell its immense hunk of bridge equity, and it was stuck with a $2.2 billion ownership stake that nobody wanted.

Still, there were no hard feelings between the partners. “Mark is an extremely talented investor and a great partner,” Mr. Speyer says. “We look forward to working with him in the future.” Of course, the most that Tishman Speyer could lose on Archstone was $250 million — a pittance next to Lehman’s total $5.4 billion exposure.

Lehman soon had much bigger worries. In March 2008, Bear Stearns nearly collapsed and was sold to JPMorgan Chase in a government-supported deal. Wall Street wondered which bank might be next to fall. Short-sellers thought they knew: Lehman Brothers.

Mr. Walsh and his crew rushed to sell their inventory. Between November 2007 and February 2008, Lehman shed $2.8 billion of its commercial real estate exposure. But that still left $36 billion of hard-to-value leftovers, including debt and equity from Archstone and SunCal.

Last spring, the hedge fund investor David Einhorn, who was shorting Lehman’s stock, suggested that the bank’s positions in Archstone and SunCal might be worthless. Mr. Einhorn said share prices of Archstone’s competitors had tumbled as much as 30 percent since the acquisition was announced. As for SunCal, he pointed out that publicly traded home builders had written down their Southern California land holdings to “pennies on the dollar.”

Mr. Einhorn called for Lehman to take a multibillion-dollar write-down on its Archstone holdings. Lehman said it was valuing its commercial real estate fairly, based on the prices that Mr. Walsh’s group had been getting on the open market as it struggled to free up the bank’s balance sheet.

Lehman ended up with $29 billion in commercial mortgage exposure on its books in the second quarter of 2008 — 30 percent more than Deutsche Bank and Morgan Stanley and 70 percent more than Goldman Sachs.

In early September, Lehman announced that it would stuff its toxic commercial mortgages into a new public company to be spun off to shareholders. The idea went nowhere. “They couldn’t get that commercial real estate off their books to save their lives,” says Mr. Hintz at Sanford C. Bernstein.

In short order, Lehman collapsed.

SOON after Lehman’s bankruptcy, a former executive who declined to be identified because he wasn’t authorized to speak publicly about his time at the firm went to Mr. Walsh’s office to talk. But they sat in silence. After two minutes, the executive left. “It became clear that neither one of us was going to say something that the other didn’t already know, or that we were going to actually have a new idea or bring greater clarity to the situation,” he recalls.

Ultimately, Barclays scooped up part of Lehman’s operations. But it dismissed Mr. Walsh and most of his team. Now the United States attorney’s office and the New Jersey attorney general are trying to determine whether Mr. Walsh did anything wrong.

But according to former Lehman executives who requested anonymity because of confidentially agreements, the values of commercial real estate holdings were determined by an independent committee outside his division.

Mr. Walsh has hired Patrick J. Smith, a former federal prosecutor who is now a partner at DLA Piper, to defend him in these investigations. Mr. Smith declined to comment for this article.

In the meantime, Mr. Walsh is staying busy. He is helping the estate of his former employer dispose of its private equity holdings. His friends say they believe that Mr. Walsh will eventually emerge from the rubble of Lehman’s collapse and return to deal-making.

“Guys like this are very rare,” says Mr. Rosen, the developer. “He’ll be back. He picked up the phone and people listen. Nobody can take that away from him.”

------------------------------------------------------------------------------------

Click here to see the page on www.nytimes.com:

How Lehman Brothers Got Its Real Estate Fix

Monday, May 4, 2009

Native Languages of the Americas: Quileute Indian Legends

This is our collection of links to Quileute folktales and traditional stories that can be read online. We have indexed our Indian stories section by tribe to make them easier to locate; however, variants on the same legend are often told by American Indians from different tribes, especially if those tribes are kinfolk or neighbors to each other. In particular, though these legends come from the Quileutes, the traditional stories of neighboring tribes like the Makah and Skagit tribes are very similar. Enjoy the stories! If you would like to recommend a Quileute legend for this page or think one of the ones on here should be removed, please contact us and let us know.

Quileute and Hoh Indian Folklore

-Quillayute Legends: Two Quileute legends about the Thunderbird.

-Thunderbird Myths: Hoh, Quileute, and Tillamook Thunderbird legends.

-Weather Myths of Cascadia: Stories from the Quileute, Hoh, Makah, and Klallam tribes.

Are the "Cold Ones" from Twilight a real Quileute legend?

No. There are no Quileute legends about "Cold Ones" or other vampires. Stephenie Meyer, the author of the "Twilight" books, has stated that she made this fictional vampire legend up herself and only had her Quileute character tell it for the purposes of her plot. However, she did base other parts of her books on real Quileute mythology. For example, it is true that according to legend the Quileute tribe is descended from wolves who were changed into men.

Recommended Books on Quileute Mythology

-Quileute Texts: Quileute myths and traditional stories, in Quileute with English translations. --The Ceremonial Societies Of The Quileute Indians: Anthropology book on traditional Quileute religious customs.

-Native Peoples of the Olympic Peninsula: The culture and history of the Quileutes and their neighbors, written by tribal members.

Additional Resources

Books of Native American myths

Quileute religion and expressive culture

------------------------------------------------------------------------------------------------

Click here to see the page on www.native-languages.org:

The Influenza Pandemic of 1918

The influenza pandemic of 1918-1919 killed more people than the Great War, known today as World War I (WWI), at somewhere between 20 and 40 million people. It has been cited as the most devastating epidemic in recorded world history. More people died of influenza in a single year than in four-years of the Black Death Bubonic Plague from 1347 to 1351. Known as "Spanish Flu" or "La Grippe" the influenza of 1918-1919 was a global disaster.

The Grim Reaper by Louis Raemaekers

In the fall of 1918 the Great War in Europe was winding down and peace was on the horizon. The Americans had joined in the fight, bringing the Allies closer to victory against the Germans. Deep within the trenches these men lived through some of the most brutal conditions of life, which it seemed could not be any worse. Then, in pockets across the globe, something erupted that seemed as benign as the common cold. The influenza of that season, however, was far more than a cold. In the two years that this scourge ravaged the earth, a fifth of the world's population was infected. The flu was most deadly for people ages 20 to 40. This pattern of morbidity was unusual for influenza which is usually a killer of the elderly and young children. It infected 28% of all Americans (Tice). An estimated 675,000 Americans died of influenza during the pandemic, ten times as many as in the world war. Of the U.S. soldiers who died in Europe, half of them fell to the influenza virus and not to the enemy (Deseret News). An estimated 43,000 servicemen mobilized for WWI died of influenza (Crosby). 1918 would go down as unforgettable year of suffering and death and yet of peace. As noted in the Journal of the American Medical Association final edition of 1918:

"The 1918 has gone: a year momentous as the termination of the most cruel war in the annals of the human race; a year which marked, the end at least for a time, of man's destruction of man; unfortunately a year in which developed a most fatal infectious disease causing the death of hundreds of thousands of human beings. Medical science for four and one-half years devoted itself to putting men on the firing line and keeping them there. Now it must turn with its whole might to combating the greatest enemy of all--infectious disease," (12/28/1918).

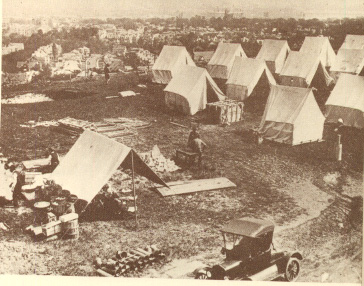

An Emergency Hospital for Influenza Patients

The effect of the influenza epidemic was so severe that the average life span in the US was depressed by 10 years. The influenza virus had a profound virulence, with a mortality rate at 2.5% compared to the previous influenza epidemics, which were less than 0.1%. The death rate for 15 to 34-year-olds of influenza and pneumonia were 20 times higher in 1918 than in previous years (Taubenberger). People were struck with illness on the street and died rapid deaths. One anectode shared of 1918 was of four women playing bridge together late into the night. Overnight, three of the women died from influenza (Hoagg). Others told stories of people on their way to work suddenly developing the flu and dying within hours (Henig). One physician writes that patients with seemingly ordinary influenza would rapidly "develop the most viscous type of pneumonia that has ever been seen" and later when cyanosis appeared in the patients, "it is simply a struggle for air until they suffocate," (Grist, 1979). Another physician recalls that the influenza patients "died struggling to clear their airways of a blood-tinged froth that sometimes gushed from their nose and mouth," (Starr, 1976). The physicians of the time were helpless against this powerful agent of influenza. In 1918 children would skip rope to the rhyme (Crawford):

I had a little bird,

Its name was Enza.

I opened the window,

And in-flu-enza.

The influenza pandemic circled the globe. Most of humanity felt the effects of this strain of the influenza virus. It spread following the path of its human carriers, along trade routes and shipping lines. Outbreaks swept through North America, Europe, Asia, Africa, Brazil and the South Pacific (Taubenberger). In India the mortality rate was extremely high at around 50 deaths from influenza per 1,000 people (Brown). The Great War, with its mass movements of men in armies and aboard ships, probably aided in its rapid diffusion and attack. The origins of the deadly flu disease were unknown but widely speculated upon. Some of the allies thought of the epidemic as a biological warfare tool of the Germans. Many thought it was a result of the trench warfare, the use of mustard gases and the generated "smoke and fumes" of the war. A national campaign began using the ready rhetoric of war to fight the new enemy of microscopic proportions. A study attempted to reason why the disease had been so devastating in certain localized regions, looking at the climate, the weather and the racial composition of cities. They found humidity to be linked with more severe epidemics as it "fosters the dissemination of the bacteria," (Committee on Atmosphere and Man, 1923). Meanwhile the new sciences of the infectious agents and immunology were racing to come up with a vaccine or therapy to stop the epidemics.

The experiences of people in military camps encountering the influenza pandemic:

An excerpt for the memoirs of a survivor at Camp Funston of the pandemic Survivor

A letter to a fellow physician describing conditions during the influenza epidemic at Camp Devens

A collection of letters of a soldier stationed in Camp Funston Soldier

The origins of this influenza variant is not precisely known. It is thought to have originated in China in a rare genetic shift of the influenza virus. The recombination of its surface proteins created a virus novel to almost everyone and a loss of herd immunity. Recently the virus has been reconstructed from the tissue of a dead soldier and is now being genetically characterized. The name of Spanish Flu came from the early affliction and large mortalities in Spain (BMJ,10/19/1918) where it allegedly killed 8 million in May (BMJ, 7/13/1918). However, a first wave of influenza appeared early in the spring of 1918 in Kansas and in military camps throughout the US. Few noticed the epidemic in the midst of the war. Wilson had just given his 14 point address. There was virtually no response or acknowledgment to the epidemics in March and April in the military camps. It was unfortunate that no steps were taken to prepare for the usual recrudescence of the virulent influenza strain in the winter. The lack of action was later criticized when the epidemic could not be ignored in the winter of 1918 (BMJ, 1918). These first epidemics at training camps were a sign of what was coming in greater magnitude in the fall and winter of 1918 to the entire world.

The war brought the virus back into the US for the second wave of the epidemic. It first arrived in Boston in September of 1918 through the port busy with war shipments of machinery and supplies. The war also enabled the virus to spread and diffuse. Men across the nation were mobilizing to join the military and the cause. As they came together, they brought the virus with them and to those they contacted. The virus killed almost 200,00 in October of 1918 alone. In November 11 of 1918 the end of the war enabled a resurgence. As people celebrated Armistice Day with parades and large partiess, a complete disaster from the public health standpoint, a rebirth of the epidemic occurred in some cities. The flu that winter was beyond imagination as millions were infected and thousands died. Just as the war had effected the course of influenza, influenza affected the war. Entire fleets were ill with the disease and men on the front were too sick to fight. The flu was devastating to both sides, killing more men than their own weapons could.

With the military patients coming home from the war with battle wounds and mustard gas burns, hospital facilities and staff were taxed to the limit. This created a shortage of physicians, especially in the civilian sector as many had been lost for service with the military. Since the medical practitioners were away with the troops, only the medical students were left to care for the sick. Third and forth year classes were closed and the students assigned jobs as interns or nurses (Starr,1976). One article noted that "depletion has been carried to such an extent that the practitioners are brought very near the breaking point," (BMJ, 11/2/1918). The shortage was further confounded by the added loss of physicians to the epidemic. In the U.S., the Red Cross had to recruit more volunteers to contribute to the new cause at home of fighting the influenza epidemic. To respond with the fullest utilization of nurses, volunteers and medical supplies, the Red Cross created a National Committee on Influenza. It was involved in both military and civilian sectors to mobilize all forces to fight Spanish influenza (Crosby, 1989). In some areas of the US, the nursing shortage was so acute that the Red Cross had to ask local businesses to allow workers to have the day off if they volunteer in the hospitals at night (Deseret News). Emergency hospitals were created to take in the patients from the US and those arriving sick from overseas.

The pandemic affected everyone. With one-quarter of the US and one-fifth of the world infected with the influenza, it was impossible to escape from the illness. Even President Woodrow Wilson suffered from the flu in early 1919 while negotiating the crucial treaty of Versailles to end the World War (Tice). Those who were lucky enough to avoid infection had to deal with the public health ordinances to restrain the spread of the disease. The public health departments distributed gauze masks to be worn in public. Stores could not hold sales, funerals were limited to 15 minutes. Some towns required a signed certificate to enter and railroads would not accept passengers without them. Those who ignored the flu ordinances had to pay steep fines enforced by extra officers (Deseret News). Bodies pilled up as the massive deaths of the epidemic ensued. Besides the lack of health care workers and medical supplies, there was a shortage of coffins, morticians and gravediggers (Knox). The conditions in 1918 were not so far removed from the Black Death in the era of the bubonic plague of the Middle Ages.

In 1918-19 this deadly influenza pandemic erupted during the final stages of World War I. Nations were already attempting to deal with the effects and costs of the war. Propaganda campaigns and war restrictions and rations had been implemented by governments. Nationalism pervaded as people accepted government authority. This allowed the public health departments to easily step in and implement their restrictive measures. The war also gave science greater importance as governments relied on scientists, now armed with the new germ theory and the development of antiseptic surgery, to design vaccines and reduce mortalities of disease and battle wounds. Their new technologies could preserve the men on the front and ultimately save the world. These conditions created by World War I, together with the current social attitudes and ideas, led to the relatively calm response of the public and application of scientific ideas. People allowed for strict measures and loss of freedom during the war as they submitted to the needs of the nation ahead of their personal needs. They had accepted the limitations placed with rationing and drafting. The responses of the public health officials reflected the new allegiance to science and the wartime society. The medical and scientific communities had developed new theories and applied them to prevention, diagnostics and treatment of the influenza patients.

-----------------------------------------------------------------------------------

Click here to see the page om the http://virus.stanford.edu/:

The Influenza Pandemic of 1918

New probable influenza case reported here

New probable influenza case reported here

The nation reported an additional probable case of H1N1 flu yesterday involving a 62-year-old woman who was aboard the same passenger airplane from Mexico with the first confirmed patient.

Korea now has two probable cases of the disease, which has officially caused nearly 20 deaths in Mexico and infected 760 people in 18 countries, including the United States, United Kingdom and New Zealand.

The latest patient is being quarantined at a military hospital south of Seoul, said Lee Jong-koo, director at the Korea Center for Disease Control and Prevention.

"Her case was established last night, and she was quarantined early this morning," Lee said in a televised briefing.

On Saturday, the center said that a 51-year-old nun confirmed as infected after a community service trip to Mexico has fully recovered. But officials said Sunday that her release remains pending.

"Test results have confirmed the first probable patient, whose case was reported on Monday, was infected with Influenza A (H1N1)," it said.

But she has been responding well to treatment, it added.

More than 330 passengers were on the airplane that arrived here last Sunday.

About two dozen people who sat close to the confirmed patient aboard the plane tested negative, according to center officials.

About 140 of them were excluded from examination because they were either foreigners or connecting passengers. Some 180 tested negative, while about a dozen have yet to be located.

The two other possible cases - a 44-year-old woman and a 57-year-old man - did not travel to affected countries, raising concerns the disease has passed from person to person in the country.

The 44-year-old woman, also a nun, who lived with the 51-year-old, who was showing symptoms at the time, drove her from the airport to their dormitory.

Test results for the 44-year-old were not yet available and she will remain isolated in a hospital for the time being, health authorities said.

But the 57-year-old man, who had been also showing probable swine flu symptoms, tested negative.

Tests are underway on 23 other people, the KCDCP said.

Korea became the 14th country that reported a confirmed case of Influenza A and the second among Asian countries following Hong Kong, health officials said.

Korea has stepped up inspections of inbound travelers after the first suspected case was reported on Monday.

It carries out rapid antigen tests on inbound travelers who are suffering from fever or symptoms of respiratory illness and restricts travel to Mexico, the epicenter of the outbreak.

If confirmed through laboratory tests, patients will immediately be isolated. Travelers to Mexico and the United States will also be educated on the prevention of swine flu, health officials said.

The government said it would double its stockpile of Tamiflu and other anti-influenza drugs to treat up to 5 million people.

From news reports

2009.05.04

-------------------------------------------------------------------------------------------------

Flu Cases Increase, but There Is Some Optimism

Flu Cases Increase, but There Is Some Optimism

By BRIAN KNOWLTON AND DENISE GRADY

Published: May 3, 2009

WASHINGTON — Swine flu has become widespread in the United States, with cases in 30 states and more expected to turn up in other states in the next few days, federal health officials reported on Sunday.

Around the world, 19 countries have now been affected, including Colombia, which earlier in the day reported the first confirmed case of swine flu in South America. About 800 people have been infected, predominantly in North America. Spain has 44 confirmed cases, more than any other European country, with Britain, Italy and Germany reporting new cases, The Associated Press reported.

Dr. Anne Schuchat, the interim Deputy Director for Science and Public Health at the Centers for Disease Control and Prevention, said at a news conference here that the virus was “circulating all over” the United States.

“The virus has arrived, I would say, in most of the country now,” she added.

By Sunday afternoon, officials reported 226 cases in the United States, an increase of 66 since Saturday, when the presence of the virus had been confirmed in 21 states.

Most cases have been mild, but 30 people have been hospitalized. And the disease, unlike the common types of seasonal flu, appears to strike an unusually high percentage of young people. The median age of people who fall ill is 17.

“Very few confirmed are over 50,” Dr. Schuchat said. “They tend to be younger. Whether it will pan out in the weeks ahead we don’t know, but it is a pattern that looks different from seasonal influenza.”

In Mexico, the hardest-hit country and where the flu was first reported, nine of the 19 confirmed deaths were between the ages of 21 and 39, which is unusually high. But on Sunday its health minister said that the worst had passed in his country.

The course of the disease in Mexico, where many other deaths suspected because of the flu, is now “in its phase of descent,” Health Minister José Ángel Cordova told a news conference, Reuters reported.

The relatively mild nature of the illness in the United States, and the apparent leveling off of cases in Mexico are encouraging, Dr. Schuchat said in Washington, but added, “I don’t think we’re out of the woods yet.”

The worrisome things about this virus, she said, is that it is new, so few people can be expected to have resistance to it, and that it is behaving unusually, flaring up and taking hold at a time when the flu season is normally just about over.

Earlier in the day, Homeland Security Secretary Janet Napolitano predicted that the World Health Organization might “very well” elevate its flu alert from Level 5 to Level 6, the highest, this week. Ms. Napolitano emphasized, however, that even the highest-level W.H.O. warning was not in itself a cause for grave concern. It would indicate that the current flu strain has reached pandemic status, but there can be a pandemic of a mild disease, and this strain is looking milder than first thought.

“Level 6, which they very well could go to this week, all that means is that it is widespread around the world,” Ms. Napolitano said on CBS’s “Face the Nation.”

The W.H.O. said Saturday that there was still no evidence of the flu’s sustained spread outside North America, a requisite condition for raising its alert level.

In Spain, all but four of the cases involved a patient who had recently traveled to Mexico, the Spanish Health Ministry said. Spain is a hub for travel to Mexico, with dozens of flights each day between the two countries.

The ministry, who said all the Spanish patients had responded to treatment, said it would be seeking to tighten controls at airports Monday but did not offer any details about addition measures. Passengers arriving from affected areas this week have been filling questionnaires about possible virus symptoms, and cabin crews have been supplied with gloves and masks in an effort to isolate suspected cases.

In the United States, Ms. Napolitano and other top officials appeared on no fewer than five morning television programs, with a message mixing caution and measured reassurance. They emphasized that since its deadly initial spread in Mexico, the disease had generally shown a milder face.

Dr. Richard Besser, acting head of the C.D.C., pointed to “encouraging signs” that the current strain might end up being no worse than a normal seasonal flu. In New York City, for example, the disease had spread quickly through a private high school in Queens, but the cases were “not that severe, and that’s encouraging,” he said on “Fox News Sunday.”

Kathleen Sebelius, who just last week was confirmed as secretary of health and human services, told Fox that there was cautious optimism in part because “the lethality which initially presented itself as part of the Mexican situation — deaths of an age group you don’t typically see” — was not being seen elsewhere.

But experts were careful to balance their cautious optimism with warnings that the flu might yet get worse.

“These viruses mutate, these viruses change, these viruses can further reassort with other genetic material, with other viruses,” said Dr. Michael Ryan, W.H.O.’s global alert and response director. “So it would be imprudent at this point to take too much reassurance.”

Infectious disease experts say it will be important to watch what this virus does in coming weeks and months, particularly in the Southern hemisphere, which will soon confront its winter flu season. If H1N1 takes hold there, that will be a red flag to scientists.

“This virus could dampen here during the summer per usual, and go to the Southern Hemisphere and pick up steam there and come back to bite us in our winter season next January and February, and it might come back in a more virulent form,” said Dr. William Schaffner, a public health and infectious disease expert at Vanderbilt University.

The U.S. health officials, quite indirectly, took exception with advice from Vice President Joseph R. Biden Jr., who said last week that he would urge his family to avoid travel if it involved “confined spaces,” such as on an airplane or a subway.

Ms. Sebelius said that she would not discourage travel unless the traveler is sick and suggested that that was what Mr. Biden had meant to say.

Exceptionally strong measures by some countries to stop the spread of the flu have led to backlashes. Egypt ordered all pigs killed, provoking violent weekend clashes between police and angry pig farmers. Scientists say the disease is not spread by consuming properly prepared pork. And Mexico complained of the quarantining of dozens of its nationals in China.

The quarantine of dozens of Mexicans in Singapore, Guangzhou and Hong Kong — as well as other guests and workers in a Hong Kong hotel — brought a pointed complaint from the Mexican foreign minister, Patricia Espinosa.

“Mexican citizens showing no signs at all of being ill have been isolated under unacceptable conditions,” Ms. Espinosa said, according to Reuters. “These are discriminatory measures, without foundation.”

Health professionals were studying a new development in Canada, where a swine herd on a family-run farm in Alberta Province apparently contracted the virus from a worker who had visited Mexico. The man-to-pig transmission appeared to be a first for this strain. Both the man and the swine have recovered; the herd remains quarantined.

There has been heated debate about whether the virus, formally known as H1N1, could infect pigs, even though its genetic makeup clearly points to its having originated in swine at some point.

Brian Knowlton reported from Washington and Denise Grady from New York. Contributing reporting were Liz Robbins and Donald G. McNeil Jr. from New York, Victoria Burnett from Madrid, Ian Austen from Ottawa and Larry Rohter from Mexico City.

------------------------------------------------------------------------------------

Click here to see the page on http://www.nytimes.com/:

Flu Cases Increase, but There Is Some Optimism

Sunday, May 3, 2009

In Capital of Mexico, Cabin Fever Takes Hold

International / Americas

In Capital of Mexico, Cabin Fever Takes Hold

By LARRY ROHTER

Published: May 3, 2009

Restrictions apply all over the country, but their effect may be felt most strongly in the capital.

MEXICO CITY — The traditionally crowded May 1 Labor Day parade was canceled, despite protests. The baseball and soccer seasons continue, but games are being played in stadiums that are empty by government decree. And with the Sabbath looming, not only are religious leaders calling off public worship services, but weddings, confirmations, pilgrimages and retreats are being postponed.

All across Mexico, the flu epidemic that has stricken more than 400 people and killed at least 16 is altering the texture of daily life in big and small ways. Barely a week after the government here announced the first measures to contain the spread of the virus, this country of about 111 million people is in lockdown and will remain that way through at least May 5.

Almost all government offices have been ordered closed, and a vast majority of private workplaces, including stores, shops, businesses and factories, have also shut down. The restrictions are part of the government’s effort to discourage people from gathering in large groups and transmitting the newly discovered flu strain, H1N1.

“Stay at home with your family,” President Felipe Calderón urged Wednesday night in a televised speech to the nation in which he ordered the five-day shutdown, which began Friday. “There is no place more secure.”

The government-decreed restrictions on public activities apply all over Mexico. Their effect, though, is perhaps felt most strongly here in the capital region, which is home to more than 20 million people and accounts for an overwhelming majority of the flu cases and the fatalities that have been reported so far.

The shutdown coincides with a long weekend holiday that extends through the traditional Cinco de Mayo commemorations on Tuesday. That annual mini-vacation in any case would have reduced activity in Mexico’s cities, as people headed to parks, resorts, beaches, relatives’ houses and other getaways. But now, with the government measures, the streets are emptied and people are mostly confined to their homes.

At this stage of the flu epidemic, with the number of newly reported cases declining, many Mexicans seem less worried about contracting the virus than about the prospect of growing bored during the imposed shutdown.

“I was really looking forward to this little break,” said Carlos Murillo Bernal, a shoe salesman. “Now I’m going to be cloistered, and I don’t know what I’m going to do with myself.”

Because of previous government restrictions on public activities, many of the most popular forms of diversion were already proscribed even before Mr. Calderón’s speech last week, and they will remain so even after May 5. The same prohibition that closes stadiums to sports fans, for instance, also applies to concert halls, movie theaters, fitness centers and gyms, museums, billiards parlors and night clubs.

Restaurants have been allowed to remain open, so long as they do not allow customers to enter and eat and drink at tables. Despite the growth of American fast food chains here, carry-out food is still a habit much less ingrained in Mexico than in the United States. As a result, many restaurants are not equipped with the containers and delivery systems they would need, and they have decided simply to shut their doors for the duration of the emergency.

“I’m suffering, but not as much as my cooks and especially my waiters,” said Antonio Calera, the owner of Hostería La Bota, a traditional downtown lunch spot that has a dozen employees. “The waiters can make 1,000 pesos on a good day,” about $70, “but now they can’t work at all, and I’ve been forced to give everybody an advance to tide them and their families through this mess.”

Supermarkets remain open, however, as do pharmacies. Though food supplies continue to be normal and shoppers calm, pharmacies have been running short of antiflu drugs like Tamiflu and Relenza, often sold here without prescriptions, of sanitizing gels and wipes and of the surgical masks that have become a common sight on streets and in the subway. It also remains open despite a steep drop in traffic.

As might be expected, the shortage of masks, whose efficiency in screening out germs is questionable but which clearly provide a psychological relief to a nervous populace, has led to profiteering, with some stores marking up the cost of certain brands to five times their pre-epidemic price. Late Thursday night, with complaints growing, Mr. Calderón made a point of going to the airport and being filmed as he monitored the arrival of a new shipment of masks, donated by China. Legislators have even been wearing them while Congress is in session.

In a pair of cases, criminals have taken advantage of the proliferation of masks in public places to use them as cover while robbing a bank and a department store. Over all, however, lawbreakers seem as intimidated by the epidemic as everyone else: according to police figures, the crime rate here has dropped more than 40 percent since the emergency began.

The most frustrated group, however, may very well be the parents of young children. The country’s estimated 33.8 million students and their 1.1 million teachers have been out of class since early last week, and schools here in the capital area have been shut down since April 24. Many parents have been forced to keep their children at home, away from outdoor playgrounds and parks, and already an outbreak of cabin fever can be detected among both adults and children.

Marta López has three children, ages 6, 4 and 2. She recited the list of distractions she has used to keep them amused for the past week: “Toys, reading them books, puzzles, television programs, movie videos, video games, sports, cooking lessons.” But she also admitted that she was running out of options and, at times, patience.

Jessica Ferrer, a mother, added, “It’s not easy.” She and her 5-year-old son, Emiliano, live in a small house with her parents, and all four had been planning to spend the long weekend in the colonial town of Taxco, south of here. Instead, Ms. Ferrer now has to figure out new ways to keep her energetic son entertained until classes resume, whenever that proves to be.

Even body language on the street seems to have changed as a result of the epidemic. As in other Latin American countries, Mexicans like to greet relatives, friends and acquaintances warmly, with kisses on the cheek and animated embraces or bear hugs.

But that cultural tradition clashes with the government’s instructions on how best to prevent the spread of the virus. “Avoid greeting with the hands or with kisses if you are ill,” warns an official poster that is on display in public places like markets, subway stations and supermarkets.

As a result, encountering a friend on the street can now lead to an awkward ballet even when both parties are healthy. People start to hug each other, realize they really should not, back away and end up settling for a clumsy bump of the elbow or shoulder.

“The force of habit is very strong, and so you forgot,” Francisco Ruiz Pacheco, a college student involved in one such exchange on Avenida Insurgentes, a main artery here, said with a grin. “I don’t want to get sick myself, but neither do I want to make someone else sick.”

------------------------------------------------------------------------------------

Click here to see the page on www.nytimes.com :

In Capital of Mexico, Cabin Fever Takes Hold

Friday, May 1, 2009

The Formula That Killed Wall Street

Recipe for Disaster: The Formula That Killed Wall StreetBy Felix Salmon 02.23.09

In the mid-'80s, Wall Street turned to the quants—brainy financial engineers—to invent new ways to boost profits. Their methods for minting money worked brilliantly... until one of them devastated the global economy.

Photo: Jim Krantz/Gallery Stock

Road Map for Financial Recovery: Radical Transparency Now!

A year ago, it was hardly unthinkable that a math wizard like David X. Li might someday earn a Nobel Prize. After all, financial economists—even Wall Street quants—have received the Nobel in economics before, and Li's work on measuring risk has had more impact, more quickly, than previous Nobel Prize-winning contributions to the field. Today, though, as dazed bankers, politicians, regulators, and investors survey the wreckage of the biggest financial meltdown since the Great Depression, Li is probably thankful he still has a job in finance at all. Not that his achievement should be dismissed. He took a notoriously tough nut—determining correlation, or how seemingly disparate events are related—and cracked it wide open with a simple and elegant mathematical formula, one that would become ubiquitous in finance worldwide.

For five years, Li's formula, known as a Gaussian copula function, looked like an unambiguously positive breakthrough, a piece of financial technology that allowed hugely complex risks to be modeled with more ease and accuracy than ever before. With his brilliant spark of mathematical legerdemain, Li made it possible for traders to sell vast quantities of new securities, expanding financial markets to unimaginable levels.

His method was adopted by everybody from bond investors and Wall Street banks to ratings agencies and regulators. And it became so deeply entrenched—and was making people so much money—that warnings about its limitations were largely ignored.

Then the model fell apart. Cracks started appearing early on, when financial markets began behaving in ways that users of Li's formula hadn't expected. The cracks became full-fledged canyons in 2008—when ruptures in the financial system's foundation swallowed up trillions of dollars and put the survival of the global banking system in serious peril.

David X. Li, it's safe to say, won't be getting that Nobel anytime soon. One result of the collapse has been the end of financial economics as something to be celebrated rather than feared. And Li's Gaussian copula formula will go down in history as instrumental in causing the unfathomable losses that brought the world financial system to its knees.

How could one formula pack such a devastating punch? The answer lies in the bond market, the multitrillion-dollar system that allows pension funds, insurance companies, and hedge funds to lend trillions of dollars to companies, countries, and home buyers.

A bond, of course, is just an IOU, a promise to pay back money with interest by certain dates. If a company—say, IBM—borrows money by issuing a bond, investors will look very closely over its accounts to make sure it has the wherewithal to repay them. The higher the perceived risk—and there's always some risk—the higher the interest rate the bond must carry.

Bond investors are very comfortable with the concept of probability. If there's a 1 percent chance of default but they get an extra two percentage points in interest, they're ahead of the game overall—like a casino, which is happy to lose big sums every so often in return for profits most of the time.

Bond investors also invest in pools of hundreds or even thousands of mortgages. The potential sums involved are staggering: Americans now owe more than $11 trillion on their homes. But mortgage pools are messier than most bonds. There's no guaranteed interest rate, since the amount of money homeowners collectively pay back every month is a function of how many have refinanced and how many have defaulted. There's certainly no fixed maturity date: Money shows up in irregular chunks as people pay down their mortgages at unpredictable times—for instance, when they decide to sell their house. And most problematic, there's no easy way to assign a single probability to the chance of default.

Wall Street solved many of these problems through a process called tranching, which divides a pool and allows for the creation of safe bonds with a risk-free triple-A credit rating. Investors in the first tranche, or slice, are first in line to be paid off. Those next in line might get only a double-A credit rating on their tranche of bonds but will be able to charge a higher interest rate for bearing the slightly higher chance of default. And so on.

The reason that ratings agencies and investors felt so safe with the triple-A tranches was that they believed there was no way hundreds of homeowners would all default on their loans at the same time. One person might lose his job, another might fall ill. But those are individual calamities that don't affect the mortgage pool much as a whole: Everybody else is still making their payments on time.

But not all calamities are individual, and tranching still hadn't solved all the problems of mortgage-pool risk. Some things, like falling house prices, affect a large number of people at once. If home values in your neighborhood decline and you lose some of your equity, there's a good chance your neighbors will lose theirs as well. If, as a result, you default on your mortgage, there's a higher probability they will default, too. That's called correlation—the degree to which one variable moves in line with another—and measuring it is an important part of determining how risky mortgage bonds are.

Investors like risk, as long as they can price it. What they hate is uncertainty—not knowing how big the risk is. As a result, bond investors and mortgage lenders desperately want to be able to measure, model, and price correlation. Before quantitative models came along, the only time investors were comfortable putting their money in mortgage pools was when there was no risk whatsoever—in other words, when the bonds were guaranteed implicitly by the federal government through Fannie Mae or Freddie Mac.

Yet during the '90s, as global markets expanded, there were trillions of new dollars waiting to be put to use lending to borrowers around the world—not just mortgage seekers but also corporations and car buyers and anybody running a balance on their credit card—if only investors could put a number on the correlations between them. The problem is excruciatingly hard, especially when you're talking about thousands of moving parts. Whoever solved it would earn the eternal gratitude of Wall Street and quite possibly the attention of the Nobel committee as well.

To understand the mathematics of correlation better, consider something simple, like a kid in an elementary school: Let's call her Alice. The probability that her parents will get divorced this year is about 5 percent, the risk of her getting head lice is about 5 percent, the chance of her seeing a teacher slip on a banana peel is about 5 percent, and the likelihood of her winning the class spelling bee is about 5 percent. If investors were trading securities based on the chances of those things happening only to Alice, they would all trade at more or less the same price.

But something important happens when we start looking at two kids rather than one—not just Alice but also the girl she sits next to, Britney. If Britney's parents get divorced, what are the chances that Alice's parents will get divorced, too? Still about 5 percent: The correlation there is close to zero. But if Britney gets head lice, the chance that Alice will get head lice is much higher, about 50 percent—which means the correlation is probably up in the 0.5 range. If Britney sees a teacher slip on a banana peel, what is the chance that Alice will see it, too? Very high indeed, since they sit next to each other: It could be as much as 95 percent, which means the correlation is close to 1. And if Britney wins the class spelling bee, the chance of Alice winning it is zero, which means the correlation is negative: -1.

If investors were trading securities based on the chances of these things happening to both Alice and Britney, the prices would be all over the place, because the correlations vary so much.

But it's a very inexact science. Just measuring those initial 5 percent probabilities involves collecting lots of disparate data points and subjecting them to all manner of statistical and error analysis. Trying to assess the conditional probabilities—the chance that Alice will get head lice if Britney gets head lice—is an order of magnitude harder, since those data points are much rarer. As a result of the scarcity of historical data, the errors there are likely to be much greater.

In the world of mortgages, it's harder still. What is the chance that any given home will decline in value? You can look at the past history of housing prices to give you an idea, but surely the nation's macroeconomic situation also plays an important role. And what is the chance that if a home in one state falls in value, a similar home in another state will fall in value as well?

Enter Li, a star mathematician who grew up in rural China in the 1960s. He excelled in school and eventually got a master's degree in economics from Nankai University before leaving the country to get an MBA from Laval University in Quebec. That was followed by two more degrees: a master's in actuarial science and a PhD in statistics, both from Ontario's University of Waterloo. In 1997 he landed at Canadian Imperial Bank of Commerce, where his financial career began in earnest; he later moved to Barclays Capital and by 2004 was charged with rebuilding its quantitative analytics team.

Li's trajectory is typical of the quant era, which began in the mid-1980s. Academia could never compete with the enormous salaries that banks and hedge funds were offering. At the same time, legions of math and physics PhDs were required to create, price, and arbitrage Wall Street's ever more complex investment structures.

In 2000, while working at JPMorgan Chase, Li published a paper in The Journal of Fixed Income titled "On Default Correlation: A Copula Function Approach." (In statistics, a copula is used to couple the behavior of two or more variables.) Using some relatively simple math—by Wall Street standards, anyway—Li came up with an ingenious way to model default correlation without even looking at historical default data. Instead, he used market data about the prices of instruments known as credit default swaps.

If you're an investor, you have a choice these days: You can either lend directly to borrowers or sell investors credit default swaps, insurance against those same borrowers defaulting. Either way, you get a regular income stream—interest payments or insurance payments—and either way, if the borrower defaults, you lose a lot of money. The returns on both strategies are nearly identical, but because an unlimited number of credit default swaps can be sold against each borrower, the supply of swaps isn't constrained the way the supply of bonds is, so the CDS market managed to grow extremely rapidly. Though credit default swaps were relatively new when Li's paper came out, they soon became a bigger and more liquid market than the bonds on which they were based.

When the price of a credit default swap goes up, that indicates that default risk has risen. Li's breakthrough was that instead of waiting to assemble enough historical data about actual defaults, which are rare in the real world, he used historical prices from the CDS market. It's hard to build a historical model to predict Alice's or Britney's behavior, but anybody could see whether the price of credit default swaps on Britney tended to move in the same direction as that on Alice. If it did, then there was a strong correlation between Alice's and Britney's default risks, as priced by the market. Li wrote a model that used price rather than real-world default data as a shortcut (making an implicit assumption that financial markets in general, and CDS markets in particular, can price default risk correctly).

It was a brilliant simplification of an intractable problem. And Li didn't just radically dumb down the difficulty of working out correlations; he decided not to even bother trying to map and calculate all the nearly infinite relationships between the various loans that made up a pool. What happens when the number of pool members increases or when you mix negative correlations with positive ones? Never mind all that, he said. The only thing that matters is the final correlation number—one clean, simple, all-sufficient figure that sums up everything.

The effect on the securitization market was electric. Armed with Li's formula, Wall Street's quants saw a new world of possibilities. And the first thing they did was start creating a huge number of brand-new triple-A securities. Using Li's copula approach meant that ratings agencies like Moody's—or anybody wanting to model the risk of a tranche—no longer needed to puzzle over the underlying securities. All they needed was that correlation number, and out would come a rating telling them how safe or risky the tranche was.

As a result, just about anything could be bundled and turned into a triple-A bond—corporate bonds, bank loans, mortgage-backed securities, whatever you liked. The consequent pools were often known as collateralized debt obligations, or CDOs. You could tranche that pool and create a triple-A security even if none of the components were themselves triple-A. You could even take lower-rated tranches of other CDOs, put them in a pool, and tranche them—an instrument known as a CDO-squared, which at that point was so far removed from any actual underlying bond or loan or mortgage that no one really had a clue what it included. But it didn't matter. All you needed was Li's copula function.

The CDS and CDO markets grew together, feeding on each other. At the end of 2001, there was $920 billion in credit default swaps outstanding. By the end of 2007, that number had skyrocketed to more than $62 trillion. The CDO market, which stood at $275 billion in 2000, grew to $4.7 trillion by 2006.

At the heart of it all was Li's formula. When you talk to market participants, they use words like beautiful, simple, and, most commonly, tractable. It could be applied anywhere, for anything, and was quickly adopted not only by banks packaging new bonds but also by traders and hedge funds dreaming up complex trades between those bonds.

"The corporate CDO world relied almost exclusively on this copula-based correlation model," says Darrell Duffie, a Stanford University finance professor who served on Moody's Academic Advisory Research Committee. The Gaussian copula soon became such a universally accepted part of the world's financial vocabulary that brokers started quoting prices for bond tranches based on their correlations. "Correlation trading has spread through the psyche of the financial markets like a highly infectious thought virus," wrote derivatives guru Janet Tavakoli in 2006.

The damage was foreseeable and, in fact, foreseen. In 1998, before Li had even invented his copula function, Paul Wilmott wrote that "the correlations between financial quantities are notoriously unstable." Wilmott, a quantitative-finance consultant and lecturer, argued that no theory should be built on such unpredictable parameters. And he wasn't alone. During the boom years, everybody could reel off reasons why the Gaussian copula function wasn't perfect. Li's approach made no allowance for unpredictability: It assumed that correlation was a constant rather than something mercurial. Investment banks would regularly phone Stanford's Duffie and ask him to come in and talk to them about exactly what Li's copula was. Every time, he would warn them that it was not suitable for use in risk management or valuation.

David X. Li

Illustration: David A. Johnson

In hindsight, ignoring those warnings looks foolhardy. But at the time, it was easy. Banks dismissed them, partly because the managers empowered to apply the brakes didn't understand the arguments between various arms of the quant universe. Besides, they were making too much money to stop.

In finance, you can never reduce risk outright; you can only try to set up a market in which people who don't want risk sell it to those who do. But in the CDO market, people used the Gaussian copula model to convince themselves they didn't have any risk at all, when in fact they just didn't have any risk 99 percent of the time. The other 1 percent of the time they blew up. Those explosions may have been rare, but they could destroy all previous gains, and then some.

Li's copula function was used to price hundreds of billions of dollars' worth of CDOs filled with mortgages. And because the copula function used CDS prices to calculate correlation, it was forced to confine itself to looking at the period of time when those credit default swaps had been in existence: less than a decade, a period when house prices soared. Naturally, default correlations were very low in those years. But when the mortgage boom ended abruptly and home values started falling across the country, correlations soared.

Bankers securitizing mortgages knew that their models were highly sensitive to house-price appreciation. If it ever turned negative on a national scale, a lot of bonds that had been rated triple-A, or risk-free, by copula-powered computer models would blow up. But no one was willing to stop the creation of CDOs, and the big investment banks happily kept on building more, drawing their correlation data from a period when real estate only went up.

"Everyone was pinning their hopes on house prices continuing to rise," says Kai Gilkes of the credit research firm CreditSights, who spent 10 years working at ratings agencies. "When they stopped rising, pretty much everyone was caught on the wrong side, because the sensitivity to house prices was huge. And there was just no getting around it. Why didn't rating agencies build in some cushion for this sensitivity to a house-price-depreciation scenario? Because if they had, they would have never rated a single mortgage-backed CDO."

Bankers should have noted that very small changes in their underlying assumptions could result in very large changes in the correlation number. They also should have noticed that the results they were seeing were much less volatile than they should have been—which implied that the risk was being moved elsewhere. Where had the risk gone?

They didn't know, or didn't ask. One reason was that the outputs came from "black box" computer models and were hard to subject to a commonsense smell test. Another was that the quants, who should have been more aware of the copula's weaknesses, weren't the ones making the big asset-allocation decisions. Their managers, who made the actual calls, lacked the math skills to understand what the models were doing or how they worked. They could, however, understand something as simple as a single correlation number. That was the problem.

"The relationship between two assets can never be captured by a single scalar quantity," Wilmott says. For instance, consider the share prices of two sneaker manufacturers: When the market for sneakers is growing, both companies do well and the correlation between them is high. But when one company gets a lot of celebrity endorsements and starts stealing market share from the other, the stock prices diverge and the correlation between them turns negative. And when the nation morphs into a land of flip-flop-wearing couch potatoes, both companies decline and the correlation becomes positive again. It's impossible to sum up such a history in one correlation number, but CDOs were invariably sold on the premise that correlation was more of a constant than a variable.

No one knew all of this better than David X. Li: "Very few people understand the essence of the model," he told The Wall Street Journal way back in fall 2005.

"Li can't be blamed," says Gilkes of CreditSights. After all, he just invented the model. Instead, we should blame the bankers who misinterpreted it. And even then, the real danger was created not because any given trader adopted it but because every trader did. In financial markets, everybody doing the same thing is the classic recipe for a bubble and inevitable bust.

Nassim Nicholas Taleb, hedge fund manager and author of The Black Swan, is particularly harsh when it comes to the copula. "People got very excited about the Gaussian copula because of its mathematical elegance, but the thing never worked," he says. "Co-association between securities is not measurable using correlation," because past history can never prepare you for that one day when everything goes south. "Anything that relies on correlation is charlatanism."

Li has been notably absent from the current debate over the causes of the crash. In fact, he is no longer even in the US. Last year, he moved to Beijing to head up the risk-management department of China International Capital Corporation. In a recent conversation, he seemed reluctant to discuss his paper and said he couldn't talk without permission from the PR department. In response to a subsequent request, CICC's press office sent an email saying that Li was no longer doing the kind of work he did in his previous job and, therefore, would not be speaking to the media.

In the world of finance, too many quants see only the numbers before them and forget about the concrete reality the figures are supposed to represent. They think they can model just a few years' worth of data and come up with probabilities for things that may happen only once every 10,000 years. Then people invest on the basis of those probabilities, without stopping to wonder whether the numbers make any sense at all.

As Li himself said of his own model: "The most dangerous part is when people believe everything coming out of it."

— Felix Salmon (felix@felixsalmon.com) writes the Market Movers financial blog at Portfolio.com.

----------------------------------------------------------------------------------

charlotte woo thought you'd like to see this on wired.com

The Formula That Killed Wall Street

Click here to see the page on wired.com:

http://www.wired.com/services/referral?messageKey=46c37562cfc55dc3cef0d15b4c1929f2